Payments & Tax

7 Minute Read

- How to request a payout

- How fast does HostJane payout?

- The dollar amounts in my reporting are wrong?

- Supported Payout Methods

- What is Form W-9?

- What is Form W-8BEN or W-8BEN-E?

- What is the 1099-K form?

- General Tax policy

- DAC7 Reporting for EU Member State Residents

- Do I have to submit tax information to my Buyer?

- Downloading statements

- Sales Tax and Related Rules

How to request a payout

- You will need to have cleared earnings or refunded money in your account before you can request a payout.

- Add an available Payout Method in Settings > Payouts.

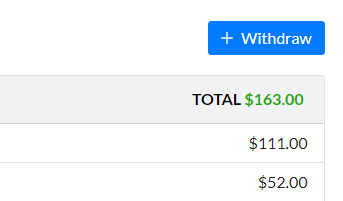

- Go to Reporting and click Withdraw

How fast does HostJane payout?

Direct credits for Harrods Hampers are 100% credited in 48 hours to your HostJane Balance to buy the item from Harrods directly. View your payout method.

To meet our anti-fraud obligations, HostJane holds other marketplace payments for Services for up to 5 days after each order is completed pending Buyer approval and compulsory feedback.

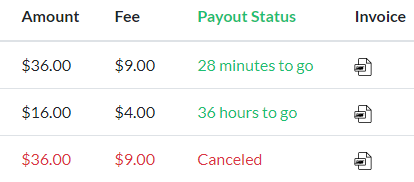

In Reporting, we keep you informed of the clearance progress of your earnings in hours and minutes for each order.

Once the countdown reaches zero in the Payout Status column of Your Sales, those earnings become available for withdrawal to your payout method.

Download a sales invoice for every transaction.

The dollar amounts in my reporting are wrong?

If you have recently made or completed a transaction, please firstly clear your cache on your device and check again.

If the amounts are still wrong are clearing cache, contact us so our billing team can have a look.

Supported Payout Methods

Withdrawal methods depend on your location. Login to your Account > Settings > Payouts to view available payout methods in your country together with timing and requirements for payouts.

What is Form W-9?

If you are legally a U.S person and you earn money through HostJane, you will need to file a W-9 Form with HostJane.

Download the W-9 Form, complete and sign it, then upload a copy to Settings > Payouts where it will be held securely on encrypted AWS servers inside the United States.

HostJane, Inc. is a US corporation. Like all other U.S.-based marketplaces and online communities, U.S. tax authorities require HostJane to collect this information.

-

HostJane is unable to release any earnings to your Payout Method until W-9 information is completed and valid on file.

-

U.S.-based users will automatically see this form in your Payout settings when you have earnings to withdraw..

If you are a U.S person living outside the U.S. and you do not see this form in your account, please contact Support because HostJane will still need a completed W-9 Form to be held on file for you.

What is Form W-8BEN or W-8BEN-E?

If you are legally a non-U.S person, even if you live outside the U.S. or never travel here, U.S. tax authorities require you to declare on a W-8BEN Form (or W-8BEN-E Form if you are a foreign company or entity) that you are not doing work within the U.S. and information about your business activities.

Download the W-8BEN Form or W-8BEN-E Form, complete and sign it, then upload a copy to Settings > Payouts where it will be held securely on encrypted AWS servers inside the United States.

- All users physically outside the U.S will automatically see this form in your Payout settings when you have earnings to withdraw.

For non-U.S. persons, HostJane is unable to release any earnings to your Payout Method until W-8 Form information is completed and valid on file.

What is the 1099-K form?

If you are a U.S person and you have earned and withdrawn over $600 dollars in the past calendar year, you will receive a 1099 NEC.

The requirement for 1099-K depends on your gross earnings on HostJane. Legally, if your HostJane earnings exceed $20,000 USD with more than 200 transactions within a single calendar year, HostJane may be required to file a Form 1099-K with the IRS to report transactions made to you.

-

All U.S-based users will automatically see this form in your Payout settings when you have earned over $20K or reached more than 200 transactions.

-

If you are a U.S person living outside the U.S. and you do not see this form in your account, please contact Support because HostJane will still need a completed 1099-K form to be held on file for you.

Copies will be filed with the IRS and emailed to Creators on your address on file. For a digital version of your Tax Form 1099, please visit your Reporting center.

HostJane will contact you if we need additional tax information from you.

General Tax policy

HostJane does not have any authority to charge or collect tax on freelance services as described in the Terms of Service.

Independent Contractors

Stated in section 9. INDEPENDENT CONTRACTOR of the Terms of Service:

HostJane and User are independent contractors and nothing contained in this Agreement places HostJane and User in the relationship of principal and agent, partners or joint venturers. Neither party has, expressly or by implication, or may represent itself as having, any authority to make contracts or enter into any agreements in the name of the other party, or to obligate or bind the other party in any manner whatsoever.

Jurisdictions

Stated in section 2.5.3 of the Marketplace Rules:

Sellers are responsible for paying any direct or indirect taxes, including any European VAT or Australian GST or otherwise, which may apply to them depending on residency or location. Sellers represent and warrant that they comply, and will comply at all times, with their obligations under income tax provisions in their jurisdiction.

DAC7 Reporting for EU Member State Residents

The European Commission’s Seventh Amendment to its Directive on Administrative Cooperation (“DAC7”) in the Field of Taxation is an EU legal requirement.

DAC7 sets out the information that marketplace platforms like HostJane, which enable Sellers to monetize content, must collect and report to EU member tax authorities regarding Sellers who are residents in one of the EU member states.

Who is affected by DAC7?

DAC7 will impact HostJane Sellers who have earned money on HostJane while residing in an EU member state including:

Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden.

- Users physically based in any of the above countries will automatically see DAC7 reporting in your Payout settings when you have earnings to withdraw.

If you do not physically reside in an EU member state, you are NOT affected by DAC7.

What content do DAC7 governments want?

Content will vary depending on which EU member state you are based in but in general will cover:

- Information about Seller’s identity (full name or legal name, primary address, and date of birth)

- EU member state of residence

- Financial account details

- Tax identification number (TIN)

- VAT/business registration numbers (for entities)

- Information about your HostJane earnings

Is DAC7 important?

Yes, we’ll send you 2 reminders within 60 days of your registration. After that time, unless you have completed your DAC7 form, HostJane cannot payout your earnings and will be required to place your account into review for us to stay compliant.

You must re-verify your DAC7 tax information any time the data on the form changes. If you have made a mistake on your submitted DAC7 form, please contact us.

Is DAC7 confidential?

Yes, HostJane’s Reporting center is secure. We use the same Secure Sockets Layer authentication used by banks to ensure that all data passed between the Web server and your browser remains private and secure.

Do I have to submit tax information to my Buyer?

You are not legally required by HostJane to submit private tax information to your Buyer.

Explained under section #9 of our Terms of Service, Sellers and Buyers on HostJane are independent contractors.

Working as a freelancer on HostJane expressly does not constitute or set up any form of employment or partnership arrangement either with the buyer or HostJane.

Downloading statements

Login to your account > Reporting to download sales invoices and receipts.

Sales Tax and Related Rules

We don’t charge or collect sales tax.

The following policy applies to:

- US Sales tax

- Australian GST

- EU VAT

- Mexican Income Tax Withholding policy

- Indian GST

Explained under 2.5 of the Marketplace Terms, Payments made through HostJane generally exclude any such tax collection unless otherwise specified.

Users and HostJane are independent contractors and each take care of their own tax reporting requirements in their own legal jurisdiction.